WITHOUT

PREMIUM PRICES

Blog

Introduction

Are you looking to purchase a used vehicle? Do you have no credit, no cosigner, or neither? At MyCarDE, we offer financial services to help anyone, regardless of credit score, purchase a used vehicle that best fits their needs. In this resource, we will walk you through your options for getting a car with no credit or cosigner, including loan services, different ways to make the process easier, and factors to consider throughout the process, including financial background, car preferences, and alternative options.

Getting a Car With No Credit

Buying a car with no credit requires careful planning, especially when it comes to your finances. Without a credit history, lenders may see you as a higher-risk borrower, making it crucial to plan your budget strategically.

Assess Financial Situation

- Determine what down payment you can afford: The down payment is one of the most significant upfront costs of buying a car. While a larger down payment can lower your monthly payments and reduce the total interest paid over the life of the loan, it’s important to choose an amount you can comfortably afford without straining your finances.

- Determine target monthly payment: Consider how much you can realistically allocate toward a car payment each month. To avoid taking on a loan that’s too difficult to manage, use online loan calculators to estimate your monthly payment based on the car price, down payment, loan term, and interest rate.

- Determine projected maintenance costs: Used cars typically come with higher maintenance needs, which can result in higher costs over the years. Research the make and model of the car you plan to purchase to gain an understanding of typical repair costs and maintenance frequency. For additional understanding of your vehicle’s needs, look into:

- Reliability Ratings: Check reviews and reliability reports to see how often the vehicle experiences major issues.

- Parts Availability: Some cars, especially older or imported models, may require harder-to-find or more expensive parts.

- Warranty Options: Determine if the car comes with a warranty or if you’d need to purchase an extended warranty to help offset repair costs.

Deciding on the Right Car

With so many different kinds of used cars and trucks available, it can be overwhelming to decide on the right one to purchase. The good news is that narrowing down your options becomes much easier when you focus on the features that matter most to your needs and lifestyle. Keeping these factors in mind will help you narrow down your options and find your perfect vehicle:

- Make or Model: If you have previously owned or driven certain brands or models, focus on picking ones you trust or prefer. Keep the size and scope of your vehicle in mind, such as whether you want to purchase a car or a truck. Additional elements to consider include reliability, resale value, and availability of replacement parts.

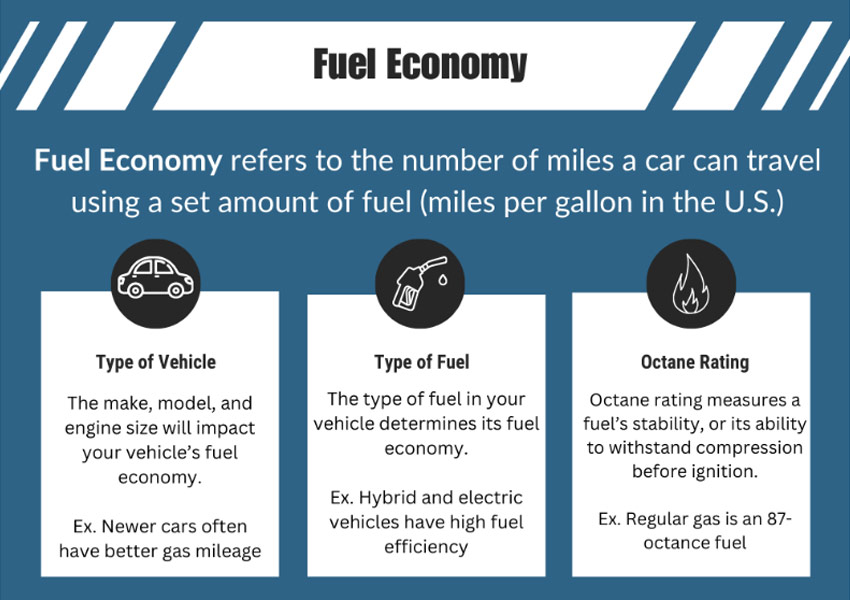

- Fuel Economy: Your vehicle's fuel economy plays a major role in your long-term costs, especially with fluctuating gas prices. If you commute frequently or drive long distances, prioritize cars with high miles-per-gallon (MPG) ratings. Hybrids or small sedans tend to offer better fuel economy, while larger trucks and SUVs might require a bigger fuel budget.

- Passenger Target: Consider the amount of passengers you’ll need to frequently accommodate. A compact car might suffice for a solo driver, but a larger family might need a midsize SUV or minivan. Don’t forget to consider cargo space needs as well, especially if you often travel with luggage, sports equipment, or other bulky items.

Getting a Car With No Credit and No Cosigner

Most first-time buyers do not need a cosigner, but they can be a helpful asset if the buyer does not have a steady income or established credit history. A cosigner, who is typically a close family member or friend, will vouch for the buyer’s ability to repay the loan, which can give lenders more confidence during the process and help establish favorable terms. For someone without any credit or with an unsatisfactory credit report, they can be an important resource when purchasing a used car and open the door for better interest rates. However, there are still special financing opportunities for an individual without credit or a cosigner, including:

- Large Security Deposit: Making a large deposit is a significant commitment, but it demonstrates the buyer’s financial responsibility and reduces the lender’s risk.

Conclusion

Bad credit? No credit? No problem! Even with your limitations, there are still options to get a car. At My Car, we are proud to serve several areas in Delaware, Maryland, Pennsylvania, and New Jersey as a full-service used car dealership. Contact us today to learn more about our options for getting an auto loan at an affordable price.

RECENT BLOGS

Showroom Hours

Contact Us

Driving directions